Point-of-Sale Trends to Watch in 2019

1. A Focus on Health Equity in Point-of-Sale (POS) Tobacco Control

As recent data from the CDC shows, while smoking rates are down to 14% among the general U.S. adult population, rates are much higher among those with lower levels of income and education, among American Indian/Alaska Natives, among men, among LGBTQ individuals, among those with mental illness, those with disabilities, those who are uninsured or on Medicaid, and those living in the South and Midwest.

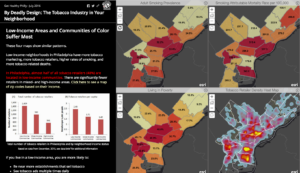

The availability and marketing of tobacco on a neighborhood level impacts these disparities. Recent data from the 500 largest cities in the United States shows that census tracts with the highest smoking rates also have more tobacco retailers, are lower-income, and have a greater proportion of people of color. [1]

Fortunately, we now know more about what works to help eliminate some of the disparities in retailer density that contribute to disparities in tobacco use. Research conducted in New York and Missouri has shown that restricting tobacco retailers from locating near schools could nearly eliminate disparities in density between neighborhoods.[2] This restriction can be accomplished through licensing, and we know that licensing strategies with caps on the number of retailers within a geographic area can also work to reduce disparities in density, as has been done in San Francisco and Philadelphia.

Health equity can be considered as a part of any tobacco control policy. For instance, with continued momentum on Tobacco 21, places considering this type of policy may want to take a close look at the language of their existing age of sale laws to make sure that it will not introduce or perpetuate potential equity issues in enforcement by penalizing the purchase, use, or possession (PUP) of tobacco rather than the sale of tobacco products. See Tobacco 21 Tips & Tools from the Public Health Law Center for more. Localities can also consider conducting a health equity impact assessment to determine what the results of any given policy may be on the ground. An approach considering social determinants of health can help practitioners ensure the benefits reach all population groups and that resources and services are distributed consistently and equally across populations so as not to exacerbate existing disparities.[3]

2. Minimum Price Policies

Continuing with the focus on health equity, price policies can also have an impact. 2019 has been declared the “Year of Cessation” by the CDC Office on Smoking and Health, and increasing tobacco prices is a proven ways to both increase cessation[4] and help reduce socioeconomic disparities in smoking.[5] Prices can be increased through excise taxes and through other policies such as minimum “floor” price policies and prohibiting coupon redemption and discounts on tobacco, which can help prevent the tobacco industry from circumventing the effects of tax increases.[6] In 2013, New York City was the first to set a minimum floor price for all cigarettes (then $10.50/pack) and Sonoma County, CA passed a policy that went into effect last year setting a minimum price of $7/pack. New York City has since raised their minimum floor price for cigarettes for $13/pack and has also set minimum prices for all tobacco products. Other localities in California, Massachusetts, and Minnesota have set minimum prices for cigars. Minimum prices policies that also prohibit the use of price promotions (e.g. coupons, multi-pack discounts) could help reduce socioeconomic disparities in smoking by raising the price of discount brands, encouraging more lower-income smokers to quit. [8] Strong minimum price laws can also prevent price manipulation by geographic area or by brand, thereby reducing targeting of products to certain populations. Models estimate that if price promotions were prohibited across the United States, smoking rates would drop by 13%, [9] and that establishing a national minimum price of $10 per pack of cigarettes could reduce cigarette sales by 5.7 billion packs per year and result in 10 million people quitting.[10] Learn more about raising the price of tobacco through non-tax approaches.

3. Continued local action on flavors and menthol

We know that youth are more likely to initiate tobacco use with a flavored or menthol tobacco product. We also know that menthol products are easier to start, harder to quit, and scientific reviews have concluded that their removal from the market would benefit public health. In 2019, keep an eye out for action from the FDA as well as on local and state action.

On November 15, 2018, FDA Commissioner Scott Gottlieb announced several steps the agency plans to take towards youth tobacco prevention, which include actions on menthol cigarettes, flavored cigars, and flavored e-cigarettes. Specifically, the FDA proposed banning menthol in cigarettes or any other combustible tobacco product, banning flavors in all cigars, and restricting the sale of flavored e-cigarettes (other than mint and menthol flavors) to age-restricted retail locations. Read more here. However, we have not seen these proposals progress farther into becoming enforceable rules and regulations, and we expect that some of them to face challenges from the tobacco industry that will further delay their implementation, which means some of these regulations could take years to become a reality.

Meanwhile, localities and states have not been waiting around for FDA action. In 2018, we saw more movement on menthol and other flavored tobacco products across the country, from cities and counties in California to those in Minnesota and Massachusetts. While some policies, like the one San Francisco, prohibit the sale of menthol and other flavored tobacco products entirely, others restrict them to adult-only stores, and still others restrict them within a certain distance of youth-serving venues like schools and parks. States are beginning to take action as well. California has proposed the first state-wide ban on flavored tobacco products, a bill introduced in New York would ban flavored e-liquid specifically, and a ban on menthol cigarettes was also proposed in New Jersey in 2018. Expect to see more policies focusing on flavors and more including menthol in 2019. See specifics about the different types of flavor policies now in place all around the country from the Public Health Law Center.

Learn more about flavored tobacco products and menthol tobacco products in our evidence summaries.

4. Tobacco 21

In 2018, the number of states that have passed Tobacco 21 laws grew from five to six, now including Massachusetts in addition to California, Hawaii, New Jersey, Maine, and Oregon. As of January 2019, at least 430 cities, towns, and counties in 23 states have also raised their minimum legal sales age to 21, a policy that now covers over 25% of the U.S. population. In early 2019, we are already seeing several additional states considering proposals to raise the legal age of sale to 21, including New York, Washington, New Hampshire, Connecticut, South Carolina, and Vermont. Given the high level of support for the policy, including among 13-17 year olds [11] and among smokers [[12, 13] we expect the list of cities, counties, and states with Tobacco 21 laws to continue to grow in 2019.

While this momentum is promising, localities considering Tobacco 21 may find it helpful to their overall tobacco control work to consider framing it as part of a broader comprehensive plan to limit youth access to tobacco and exposure the effects of tobacco marketing and/or including it as part of a licensing program that allows for both enforcement and for additional point-of-sale tobacco control interventions. See more about this in our next trend to watch…tobacco retailer licensing.

5. Local Tobacco Retailer Licensing

Tobacco retailer licensing (TRL) is a regulatory tool that can be used to implement a range of policies. In the simplest form, a TRL policy requires stores that want to sell tobacco to obtain a license to do so from the city, county, and/or state. Strong TRL ordinances also require retailers to pay an annual fee to apply for or renew a license to sell tobacco products, set at a level that covers the cost of administration and enforcement of the license. A study published in the journal Pediatrics earlier this year showed that strong TRL policies may lower youth initiation of both cigarettes and e-cigarettes.[14] In California localities that had a strong TRL, youth were 33% less likely to have initiated cigarette use and 26% less likely to initiate e-cigarette use over the course of 1.5 years compared to localities that had no licensing law or did not have a licensing fee high enough to cover the costs of enforcement.[14]

In addition, licensing allows for more accurate tracking of all tobacco retailers in a given locality and can serve as a platform on which to build other regulations that can have a large impact on the community environment, such as restricting the density, type, and location of tobacco retail outlets. An increasing number of localities are advocating for and implementing TRL policies to address youth access, disparities in retailer density, and to begin regulating e-cigarette sales and vape shops. The Surgeon General’s advisory on the e-cigarette epidemic among youth recommended licensing retailers as one evidence-based population-level strategy to reduce e-cigarette use among young people.

San Francisco currently has the most comprehensive tobacco retailer licensing policy – capping the number of licenses permitted in each of the city’s 11 districts at 45 and prohibiting any new retailer from locating within 500 feet of a school or other retailer. However, more cities are moving towards a similar model. In December 2016, Philadelphia passed a law limiting the number of tobacco retailers to 1 per 1000 people in each planning district and prohibiting new tobacco retailers within 500 feet of a school. In addition, at least 112 cities and towns in Massachusetts have instituted some sort of cap on the total number of tobacco retail outlets, and many of them also have restrictions on how close tobacco retailers can be located to schools. Several cities in California, Colorado, Illinois, New York, and Wisconsin also limit retailers within 500 or 1000 feet of schools.

Mapping can help communities determine the impact of any given TRL policy on the ground – e.g. how many tobacco retailers are currently located near schools in their town or where disparities in tobacco retailer density rates exist in their community. It can also help determine what TRL “plug-ins” might have the most impact on the tobacco retail environment in their community.

6. Tobacco-Free Pharmacies

6. Tobacco-Free Pharmacies

In 2018, Massachusetts became the first state to prohibit the sale of tobacco products in pharmacies (and all healthcare institutions). This was preceded by a groundswell of local action. Following Boston’s action in 2008 to become the second city in the nation to ban tobacco sales in pharmacies, over the next 10 years more than 160 cities and towns across the state of Massachusetts did the same. Also in 2018, Albany County and Erie County in New York joined Rockland County and New York City, NY in tobacco-free pharmacy policies. In January 2019, New York Governor Cuomo announced a proposal to prohibit the sale of tobacco in pharmacies statewide as part of comprehensive legislation to curb tobacco use. San Francisco and at least 14 places in California also prohibit tobacco sales in pharmacies.

Localities can create tobacco-free pharmacies as part of a tobacco retailer licensing program by restricting the type of stores that may be issued a license to exclude pharmacies, or through a law that directly prohibits tobacco sales in pharmacies. Prohibiting tobacco sales in pharmacies is one strategy for reducing tobacco retailer density. New York City’s policy is projected to decrease tobacco retailer density by 6.8% across the city and by up to 15% in some neighborhoods.[15] The steeper decreases in density in NYC will be seen in largely higher-income, white neighborhoods, while neighborhoods with more Hispanic residents and residents with lower levels of education will see less substantial reductions. [15] However, tobacco-free pharmacy policies can be paired with other retailer restrictions, such as neighborhood-based retailer caps, as NYC is also implementing, or restricting stores near schools, which can help reduce income- and race-based disparities in retailer density.

Ending tobacco sales in pharmacies is a policy with broad support from pharmacists and the overall public, and retailers are starting to take notice. CVS, the nation’s largest pharmacy chain ended tobacco sales in 2014, but Walgreens, the second largest, has resisted pushes for them to follow suit. Truth Initiative and the Campaign for Tobacco Free Kids have both led efforts calling on Walgreens to end tobacco sales, and a recent survey says Walgreens customers would be on board with the change. This past year, Walgreens dipped a toe in the water by piloting an end to tobacco sales in their stores in Gainesville, FL. It remains to be seen if they’ll scale that pilot up or make the policy official nationwide, but 2018 put them in the hot seat even more with data showing that at a violation rate of 10.3%, Walgreens had the highest rate of sales to minors of any other pharmacy chain between 2012-2017.

Taking tobacco sales out of pharmacies just makes sense to make sure retailers selling products to help treat tobacco-related illnesses aren’t also selling the very products that cause them. Learn more here.

7. Lots of Local Action

Lots of local action is making the tobacco industry worried. Between 2017-2018, R.J. Reynolds spent over $12 million to fight San Francisco’s policy prohibiting the sale of menthol and other flavored tobacco products, forcing it to a referendum in which voters upheld the flavor ban. Tobacco companies know that local action drives larger state and federal changes, and the policies they’re willing to fight (like the menthol ban) are the ones that can have the biggest impact on tobacco use. You can keep tabs on some of the arguments the tobacco industry is feeding to retailers and what ordinances they are organizing to fight via the Tobacco Ordinance Take Another Look (TOTAL) site developed by the National Association of Tobacco Outlets and cigar and smokeless tobacco company Swedish Match. You can also find counter arguments from the Campaign for Tobacco-Free Kids in direct response to the misleading claims on the TOTAL site here. Similarly, in response to the tobaccoissues.com site operated by Philip Morris USA, U.S. Smokeless Tobacco Co., John Middleton, Nat Sherman, and Nu Mark, see the Public Health and Tobacco Policy Center’s resource, Oh Snap! Countering Tobacco Industry Opposition to Local Tobacco Control. Speaking of local control…

8. Pushes for (and against) Preemption

In 2018, we unfortunately saw a number of successful preemption bills and more attempts to prevent evidence-based tobacco control policies from being implemented on the local level. For example, in June 2018, the City of Philadelphia was considering an ordinance that would have banned the sale of flavored little cigars and cigarillos. The city had chosen to focus on these products in part because cigar use rose from 6.0% to 10.5% from 2011 to 2015, surpassing cigarette use among youth, and tripling among black youth (rising from 4.5% in 2011 to 11.9% in 2015). However, a last-minute amendment (reportedly with language from Big Tobacco) was added to the Pennsylvania State Budget that prevents Philadelphia from passing any new regulations on tobacco sales except for how tobacco products are displayed. Read more here and here. Similarly, in July 2018 in Hawaii, a last-minute provision was added to a bill funding kidney dialysis centers that prevents local governments from regulating the sale of tobacco and e-cigarettes. It also voids any existing local regulations that conflict with state statute.

However, some states with preemption currently in place are beginning to push back on those limits to local authority. In early 2018, a bill was introduced in the Kentucky legislature to repeal preemption and allow cities and counties to regulate the use, display, sale or distribution of tobacco and vapor products. In Colorado, a bill currently under consideration would remove restrictions on local cigarette regulation. As of now, if local a CO jurisdiction passes a retail licensing law for cigarettes or a cigarette tax law, that jurisdiction would forfeit eligibility to receive their portion of cigarette sales tax money from the state. The new proposed law would remove that restriction and give counties the express authority to regulate the sale of cigarettes and other tobacco or nicotine products. Read more.

Preemption is one of the tobacco industry’s favorite tools to limit local innovation and prevent the implementation of life-saving policies at the local level. We know that local-level policy work often precedes state-level adoption of a policy, so tobacco companies have a vested interest to keep local power limited – and they often have more influence at the state level. You can track tobacco political action committee (PAC) donations to your members of congress here. If you are in a state with preemption on many POS tobacco control policies, find out what you can do here.

9. Debate Over Balancing Harm Reduction and Youth Tobacco Use Prevention

The FDA’s new comprehensive plan for tobacco and nicotine regulation acknowledges a continuum of risk for nicotine delivery products from combustible cigarettes to nicotine replacement therapies and has encouraged innovations in products that are potentially less risky.

A 2018 congressionally mandated report on the Public Health Consequences of E -Cigarettes from the National Academies of Science, Engineering, and Medicine found that e-cigarettes are likely less harmful than conventional cigarettes and may help adults quit smoking, though more research needs to be done on the specific conditions under which this can occur. While they found conclusive evidence that completely switching to e-cigarettes reduces exposure to toxicants and carcinogens found in conventional cigarettes, the report also finds that there is substantial evidence that among youth, e-cigarette use increases the risk of later smoking conventional cigarettes. The report says that the overall impact of e-cigarettes on public health is still unknown, with more research needed on both the short and long-term effects of use, as well as their relationship to cigarette use. In addition, recent research shows that people who continue to use both regular cigarettes and e-cigarettes (as 60% of adults e-cigarette users do) are exposed to more toxicants than using either product alone.[16]

A 2018 congressionally mandated report on the Public Health Consequences of E -Cigarettes from the National Academies of Science, Engineering, and Medicine found that e-cigarettes are likely less harmful than conventional cigarettes and may help adults quit smoking, though more research needs to be done on the specific conditions under which this can occur. While they found conclusive evidence that completely switching to e-cigarettes reduces exposure to toxicants and carcinogens found in conventional cigarettes, the report also finds that there is substantial evidence that among youth, e-cigarette use increases the risk of later smoking conventional cigarettes. The report says that the overall impact of e-cigarettes on public health is still unknown, with more research needed on both the short and long-term effects of use, as well as their relationship to cigarette use. In addition, recent research shows that people who continue to use both regular cigarettes and e-cigarettes (as 60% of adults e-cigarette users do) are exposed to more toxicants than using either product alone.[16]

Meanwhile, youth use of e-cigarettes use has reached levels described by the Surgeon General is a rare advisory issued on the topic as an “epidemic.” Between 2017 and 2018, youth use of e-cigarettes skyrocketed, with the largest one-year increase in any kind of substance use by adolescents in the past 44 years. Fueling a large part of this growth, Juul e-cigarettes continued their almost exponential rise in popularity in 2018 (particularly among youth) and ended the year with over three-quarters of the market share. While the company has taken some steps voluntarily to reduce their appeal to youth and has shifted their marketing to focus on getting people to switch from cigarettes, they have also partnered with tobacco industry giant Altria, a move that seems to follow Big Tobacco’s playbook of putting profit above all else. It will be important to monitor how these products are marketed and promoted in the retail environment as their popularity continues.

In 2019, as we wait on any additional moves forward from the FDA regarding youth access to e-cigarettes and e-cigarette product reviews, we will likely see shifts from other Big Tobacco companies as well as they try to compete with Juul, and ultimately as they try to stay in (the addiction) business.[17] While Big Tobacco talks about a “smoke-free world,” they continue to market the most deadly of their products aggressively both in the U.S. and in low- and middle-income countries, where they see untapped markets. Don’t expect voluntary action from Big Tobacco to result in the end of cigarettes.

POS policies can help reduce youth access to these products. The Surgeon General recommends that states, communities, tribes, and territories, “Implement evidence-based population-level strategies to reduce e-cigarette use among young people” including restricting young peoples’ access to e-cigarettes in retail settings, licensing retailers, and implementing price policies.

Other products that the tobacco industry is trying to promote as “reduced risk” are on the horizon as well, though an FDA panel found that the heated tobacco product iQOS did not substantially reduce risks of tobacco related death and disease.

We’ll be keeping an eye on these trends in 2019, while also staying focused on combustible tobacco products (i.e. cigarettes, cigarillos, cigars). While the long-term effects of e-cigarette use are still unknown, we do know that combustible tobacco products are the leading cause of death and disease in the U.S., contributing to 480,000 premature deaths each year, and with the tobacco industry spending over $6.5 billion yearly to market these deadly products at the point of sale, we’ve got plenty of work to do fighting the “War in the Store.”

10. Partnerships to create healthier places: tobacco, food, alcohol, marijuana, and physical activity.

Intervention in the retail setting presents the opportunity to address multiple factors that influence health. The evidence behind how exposure to tobacco advertising and promotions at the point of sale contributes to tobacco use behaviors continues to grow. Across multiple studies, research has shown that youth more frequently exposed to tobacco promotion are 60% more likely to have tried smoking and 30% more likely to be susceptible to future smoking.[18] However, community interest in creating healthy retail environments continues to grow – not only with regard to tobacco but also including alcohol, food, and marijuana, as well as how the community retail environment can support physical activity. The retail environment includes both the community environment (e.g. number, type, and location of stores) and the consumer environment (e.g. what products are sold, how they are advertised, prices, etc.). A study of food retailers that also sold tobacco in three North Carolina counties found that the community and consumer environments for nutrition, physical activity, and tobacco were inter-related, indicating that measures assessing solely community level can miss characteristics of the consumer environment. [19]

Policies can address the retail environment holistically as well, tackling multiple issues at the point of sale in coordination instead of addressing each in isolation. The authors of the study in North Carolina suggest that food ordinances requiring licensed grocery stores to sell a minimum standard of healthy food, like Minneapolis’s staple food ordinance, can be expanded to place a cap on the amount of tobacco marketing allowed outside the store to reduce youth exposure.[19] Given that areas with a higher number of tobacco retail outlets are also more urban and more walkable, restricting exterior advertisements to reduce youth exposure may be more important.[19] Further improvements to the aesthetics of the store exterior, such as better lighting, removing graffiti, providing adequate trash receptacles, and preventing loitering could be incorporated as requirements for participation in healthy store programs in order to encourage walkability and active transport around the store.[19]

Monitoring and tracking of the sale of tobacco, e-cigarettes, alcohol, marijuana, food and beverages can be done with the Counter Tools’ Store Audit Center. For more information on other food environment measurements, look to the National Collaborative on Childhood Obesity Research’s Measures Registry.

For more strategies on interdisciplinary collaboration to create healthy retail environments, review:

- Case Study: Healthy Retail San Francisco

- Integrating Tobacco Control and Obesity Prevention Initiatives at Retail Outlets, published in the journal Preventing Chronic Disease.

- ChangeLab Solution’sHealthy Retail: A Set of Tools for Policy and Partnership, which includes a healthy retail Playbook, Conversation Starters, and a Collaboration Workbook.

- California Department of Public Health’s Healthy Stores for a Healthy Community

- SmokeFree Philly’s Healthy Retailer pilot project