The War in the Store

A ‘War in the Store’ Started Twenty Years Ago, and the battle still rages on…

Tobacco companies now spend the vast majority of their advertising and promotional dollars at the point of sale, vying for customer hearts and minds. This “War in the Store” was triggered in 1993 when Philip Morris heavily discounted its Marlboro brand, and other tobacco companies followed suit to compete.

While the Master Settlement Agreement of 1998 (an agreement between the major tobacco companies and 46 state attorney generals) curtailed some tobacco company advertising. For instance, by getting rid of Joe Camel and other cartoon characters and banning product ads on billboards and magazines, it left the store environment relatively free of restrictions. The tobacco industry took full advantage of the gap.

Point of sale (POS) marketing targets both consumers and retailers. POS promotions include exterior and interior tobacco advertisements, price discounts, product placement strategies, incentives offered to retailers to increase in-store marketing, and many other strategies.

Spending at the Point of Sale: Federal Trade Commission Reports

Cigarette companies have always valued the retail point of sale as an advertising channel, but in the last decade, spending on branded advertising and promotions at the point of sale has soared. In fact, the retail environment is now the lead channel for cigarette marketing, advertising, and promotional efforts.

The Federal Trade Commission has been preparing reports on sales, advertising, and promotions of cigarettes since 1967, using data gathered from the five major tobacco companies, Altria Group (Philip Morris products including Marlboro), Reynolds America (Camel, American Spirit), Commonwealth Brands (USA Gold, Phillies, Dutch Master), Lorillard (Newport), and Vector Group (Pyramid, Liggett). Since 1987, the FTC has tracked sales and promotions of smokeless tobacco from Altria Group (Copenhagen, Skoal), North Atlantic Trading Company (Trophy, Durango), Reynolds America (Grizzly), Swedish Match North America (Longhorn, General), and Swisher International (Redwood Snuff) . Reports are issued every few years and give tobacco control advocates detailed advertising and promotion spending reports in more than two dozen categories.

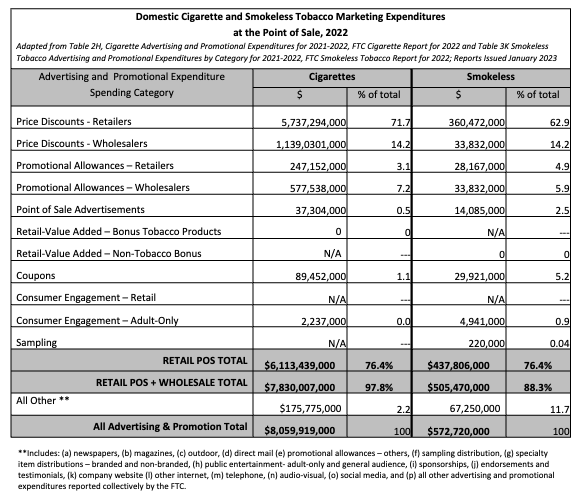

In 2022, the tobacco industry spent over 97% of their total marketing expenditures for cigarettes and smokeless tobacco in the retail environment. They spend the majority of this money on price discounts and promotional allowances to keep products cheap and visible at the point of sale.

- What are Price Discounts? Price discounts are what tobacco companies pay to tobacco retailers or wholesalers in order to reduce the price of cigarettes to consumers, including off-invoice discounts, buy-downs, voluntary price reductions, and trade programs.

- What are Promotional Allowances? Promotional allowances are what tobacco companies pay to either tobacco retailers or wholesalers in order to facilitate the sale or placement of tobacco products. For retailers, this can include payments for stocking, shelving, displaying and merchandising brands, volume rebates, incentive payments, and the cost of tobacco products given to retailers for free for subsequent sale to consumers. For wholesalers, this can include payments for volume rebates, incentive payments, value added services, promotional execution and satisfaction of reporting requirements.

As seen in the table below, according to the Federal Trade Commission Cigarette and Smokeless Tobacco Report for 2022, the tobacco industry spent over $8.3 billion to advertise and promote their products in the retail environment. Of the $8.3 billion spent at the point of sale, $6.6 billion was spent directly in the retail environment, including price discounts and promotional allowances paid to retailers, coupons, sampling, and consumer engagement, with the remainder comprised of price discounts and promotional allowances paid to wholesalers, which also ultimately reduce the price of products to consumers. In 2022, cigarettes sales decreased to 172.5 billion – an 8.8% drop from 2021. This marks the second time cigarette sales fell under 200 billion, following a similar drop in 2021. This decline represents enormous public health progress over the course of decades, but so much work still remains, particularly at the point of sale. The FTC data also shows the consequences of the fact that while public health policies have set limits on avenues for tobacco marketing, the retail environment remains relatively free of restrictions. The tobacco industry continues to take full advantage of that gap, spending the large majority of all of their marketing dollars there – at the point of sale.

Price discounts are the largest category of expenditures for both cigarettes and smokeless tobacco, totaling nearly 86% of total industry spending on cigarettes and smokeless tobacco combined.

Spending aimed specifically at the retail point of sale is comprised of five categories: (a) point-of-sale advertisements, (b) price discounts to retailers, (c) promotional allowances to retailers, (d) retail-value added bonus tobacco products and bonus non-tobacco products, (e) coupons, (f) consumer engagement, and (g) sampling. While some sampling may occur at pop-up events or other non-brick-and-mortar spaces, we have included it here because of the significant proportion of sampling that does happen in retail settings for e-cigarettes in particular. Other marketing dollars not considered to be aimed at POS include, for example, dollars spent on direct mail, magazines, internet, or sponsorships. We have included information about promotional allowances and price discounts to wholesalers to account for their role in reducing retail prices for consumers.

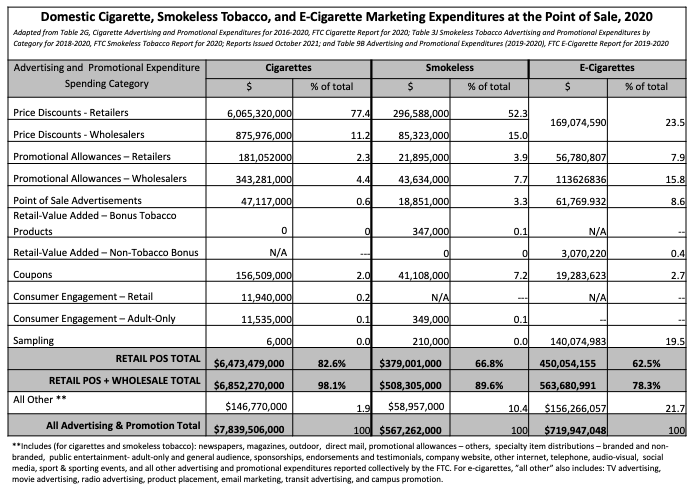

In October 2019, the FTC issued orders to 6 major e-cigarette companies (Fontem US, Inc.; JUUL Labs, Inc.; Logic Technology Department LLC; NJOY, LLC; Nu Mark LLC; and R.J. Reynolds Vapor Company), seeking information on their sales, advertising, and promotional activities from 2015-2018. On March 17, 2022, the FTC published their first report on e-cigarettes using that data, and the second report, covering data from 2019-2020, was published August 31, 2022 (see our summary of that data here: FTC E-Cigarette Report Shows Importance of Flavors, Price Discounts). We will report on the 2021 e-cigarette data from the FTC separately when they are released, as well as report on the combined sales and marketing expenditures across products. However, you can see the expenditure breakdowns by category across all three product types for 2020 in the table below.

What Does Point of Sale Spending Buy the Tobacco Industry?

Heavy spending on marketing and promotions at the POS buy the tobacco companies many things – brand recognition, brand preference, tobacco product cravings and unplanned purchases, fewer successful quit attempts, perceived norms of higher smoking prevalence, and increased initiation and continuation of tobacco use, especially by youth, viewed as an important age group to fuel the tobacco companies’ futures.

Evidence suggests that tobacco ads at the point of sale may be most prevalent at stores that adolescents shop at frequently as well, and greater exposure to these POS ads and promotions is associated with greater likelihood of smoking.

Find out more about how POS promotions are used to target youth at stores near schools and contribute to health disparities in lower-income and higher-percent minority communities.

Listen to our podcast episode about “The War in the Store:”

What You Can Do

Countertobacco.org is your complete resource to counteract commercial tobacco product marketing at the point of sale. We offer a comprehensive toolkit to assist your efforts around six unique yet complementary policy solutions. On each page you will find an overview of the particular solution, research findings, tools, case studies, and links to additional partners and resources to help gather support for your work. See the policy solutions listed below to see what may work best for your state or locality. Also use our evidence summaries for more information on special topics, such as tobacco stores near schools. Check out our glossary for a primer on POS terminology.

Take a look around the site and get in touch. Our goal has been to compile – in one place – everything you will need to counter tobacco at the point of sale. If you cannot find what you are looking for, please let us know. And, check back for periodic updates.