The Federal Trade Commission (FTC) has issued reports on tobacco companies’ marketing expenditures for cigarettes and smokeless tobacco for decades; however in October 2019, the FTC issued orders to 6 major e-cigarette companies (Fontem US, Inc.; JUUL Labs, Inc.; Logic Technology Department LLC; NJOY, LLC; Nu Mark LLC; and R.J. Reynolds Vapor Company), seeking information on their sales, advertising, and promotional activities from 2015-2018. On March 17, 2022, the FTC published their first report on e-cigarettes using that data (see our summary here). The second report, covering data from 2019-2020, was published August 31, 2022. Below are the key findings:

Sales

Overall expenditures and promotion for e-cigarette products continued to increase from over $643 million in 2018 to over $1 billion total in 2019 before declining to still nearly $720 million in 2020. The data show that most e-cigarette sales are happening at retail stores – representing 91.6% of dollar sales in 2019 and 92.3% in 2020.

The data also clearly show an increase in sales of both disposable e-cigarettes and menthol e-cigarette cartridges following the January 2020 federal ban on the sale of e-cigarette cartridges in flavors other than menthol and tobacco, as youth pivoted to using products that remained flavored. Menthol-flavored cartridges comprised 16.7% of cartridges sold in 2019 but 63.5% of all cartridges sold in 2020.

In addition to exempting menthol-flavored cartridges, the federal ban did not cover disposable e-cigarettes. While the FTC notes that only 2 of the 5 companies they requested data from continued to sell disposable e-cigarettes in 2020, they have now requested data from 4 additional e-cigarette companies to include in future reports. In addition, sales data analyzed by the CDC Foundation found that “other” flavored disposable e-cigarettes (candy, fruit, spice, etc.) accounted for 77.6% of all disposable sales in December 2020. According to the National Youth Tobacco Survey, as of 2021, disposables were the most popular type of e-cigarettes, with Puff Bar emerging as the most popular brand.

The FTC report also shows that fewer cartridge-style e-cigarette systems are being sold in “starter kits” with a device and cartridges bundled together. These bundles accounted for 26.9% of sales in 2019 but only 2.6% of sales in 2020. Cartridges are most often sold in packs of 2 or 4, with 43.8% sold in packs of 2 and 55.1% sold in packs of 4 in 2020. Nearly 98% of disposable e-cigarettes were sold as singles in 2019 and 99% were sold as singles in 2020.

The report also includes information on nicotine concentrations in e-cigarettes, which remain high. The average nicotine concentration increased from 49.4mg/ml in 2018 to 52.3mg/ml in 2019 and then decreased slightly to 51.2 mg/ml in 2020.

Advertising & Promotions

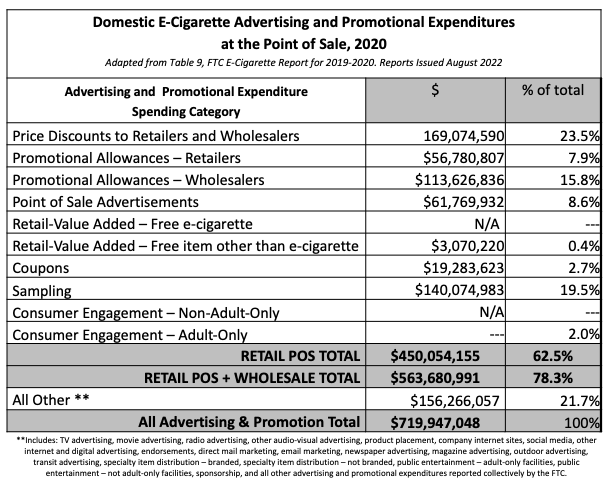

The report shows that, as is the case with tobacco industry marketing expenditures for cigarettes and smokeless tobacco, the retail setting is where e-cigarette companies are spending the vast majority of their money, with over 62.5% spent directly in the retail setting in 2020 and over 78% when factoring in promotional allowances paid to wholesalers. Here’s what they’re spending it on:

- Price discounts paid to retailers and wholesalers. As with cigarettes and smokeless tobacco, the largest category of advertising expenditures is on price discounts, which reached a peak of $182.3 million in 2019 before declining somewhat to $169.1 million in 2020. These discounts reduce the price of e-cigarette products to consumers and include off invoice discounts, buy downs, voluntary price reductions, and trade programs. Price discounts also lead to higher rates of tobacco use among youth.

Sampling and distribution of free and deeply discounted e-cigarette products. Spending on this category doubled over the course of 2018-2019 and continue to rise in 2020, becoming the second largest category of expenditures at $140 million. Note that many companies offer products at $1 or less to get around the FDA’s 2016 ban on free samples.

Sampling and distribution of free and deeply discounted e-cigarette products. Spending on this category doubled over the course of 2018-2019 and continue to rise in 2020, becoming the second largest category of expenditures at $140 million. Note that many companies offer products at $1 or less to get around the FDA’s 2016 ban on free samples.- Promotional allowances paid to retailers and wholesalers. Promotional allowances that facilitate the sale or placement of e-cigarette products declined from 2018 levels but remained one of the top categories of spending. Promotional allowances paid to retailers declined from $73.9 million in 2018 to $51.2 million in 2019 and then rose to $56.8 million in 2020. Promotional allowances paid to wholesalers declined from $141.4 million in 2018 to $126.8 million in 2018 and again to $113.6 million in 2020. For retailers, this includes payments for stocking, shelving, displaying, and merchandising brands, volume rebates, incentive payments, and the cost of e-cigarette products given to retailers for free for subsequent resale to consumers. For wholesalers, this includes payments for volume rebates, incentive payments, value-added services, promotional execution, and satisfaction of reporting requirements.

- Point-of-sale advertising. Expenditures on e-cigarette advertising at the point of sale nearly doubled from $45.9 million in 2018 to $85.7 million in 2019 and then declined to $61.8 million in 2020.

- Coupons. Another way e-cigarette companies keep their products cheap, expenditures on coupons grew from $36.5 million in 2018 to $44.2 million and then declined to $19.3 million 2020.

E-cigarette companies are spending their money where they know it matters. They’re aiming to keep their products cheap and visible in the retail environment. Research shows that exposure to tobacco marketing can cause youth to start smoking, keep people who currently smoke hooked, and make it harder for people to quit and stay quit. E-cigarette companies know that keeping prices low drives use. While research on the impacts of e-cigarette pricing is less extensive than on the impacts of cigarette pricing, the existing data show that both disposable and reusable e-cigarette sales are also responsive to price.[1] When e-cigarette prices increase, sales decrease, particularly among price-sensitive groups like youth. We know that lower prices, along with coupons and price discounts, encourage youth to start smoking and move them along from experimentation to regular cigarette use.[2] E-cigarette companies engage in these practices because the same thing is likely to happen with e-cigarettes.

To learn more about e-cigarette sales and marketing expenditures, read the press release from the FTC or download the full report. To learn more about how tobacco companies spend their marketing dollars on cigarettes and smokeless tobacco, read our summary on the War in the Store. Learn more about e-cigarettes at the point of sale in our evidence summary.