Background

The Federal Trade Commission (FTC) has issued reports on tobacco companies’ marketing expenditures for cigarettes and smokeless tobacco for decades; however starting in 2022, the agency began issuing reports on the sale and marketing expenditures of major e-cigarette companies as well.

- The first report, published in March 2022, contained information on the sales, advertising, and promotional activities from 2015-2018 from 6 e-cigarette companies who were then leading manufacturers: Fontem US, Inc.; JUUL Labs, Inc.; Logic Technology Department LLC; NJOY, LLC; Nu Mark LLC; and R.J. Reynolds Vapor Company) See our summary here.

- The second report, covering data from 2019-2020, was published August 31, 2022 and covered data from the five e-cigarette companies previously reported on that were still selling e-cigarettes (Nu Mark stopped manufacturing and distributing e-cigarettes at the end of 2018). See our summary here.

- The third report, issued earlier this month and summarized below, focuses on data from nine leading manufacturers in 2021, including the five companies previously reported on, which mostly manufacture and sell cartridge-based e-cigarettes. The four additional companies, which primarily manufacture and sell disposable e-cigarettes, include: Breeze Smoke, LLC; Kavival Brands Innovation Group, Inc; Pop Vapor Co., LLC; and PVG1, LLC (which markets Puff Bar e-cigarettes). The FTC notes that while these four companies were likely some of the leading marketers of disposable e-cigarettes, the market for those products is much more fragmented than the market for cartridge-based products, so the report is likely less representative of the disposable market. The report also contains corrected data for 2019 and 2020 as well as 2020 data from the four additional companies not covered in previous reports.

Sales

- Overall: Sales of cartridge-based and disposable e-cigarette products totaled over $2.67 billion in 2021, an increase of about $370 million from 2020.

- Cartridge-based e-cigarettes: Sales of cartridge-based products increased from $2.133 billion to $2.496 billion

- Sales of one or more cartridges by themselves decreased from 96.1% of dollar sales of closed-system products in 2020 to 93.9% in 2021.

- Sales of devices sold by themselves increased from 3.7% of cartridge system sales in 2020 to 5.6% in 2021

- Sales of cartridge and device bundles increased from 0.1% of closed-systems sales in 2020 to 0.5% in 2021.

- Disposable e-cigarettes: Sales of disposable e-cigarettes increased from $261.9 million to $267.1 million

- Cartridge-based e-cigarettes: Sales of cartridge-based products increased from $2.133 billion to $2.496 billion

- Flavors: We know that flavors are a key driver of youth use of e-cigarettes. The 2023 National Youth Tobacco Survey showed that nearly 90% of youth who use e-cigarettes use flavored varieties.

- Cartridge-based e-cigarettes: In 2021, 69.2% of e-cigarette cartridges sold or given away were menthol flavored, while the rest were tobacco-flavored. All other flavors of cartridge-based e-cigarettes were prohibited under federal law in January 2020.

- Disposable e-cigarettes: In 2021, 71% of disposable e-cigarettes sold or given away were “other” flavored, with the most popular types being fruit-flavored (28.52%) and fruit & menthol/mint-flavored products (27.95%). With menthol flavor accounting for 9.88% and mint flavor accounting for 9.13%, nearly half (49.8%) of all disposable e-cigarette products sold or given away were either primarily mint or menthol-flavored or included mint or menthol (e.g. strawberry mint, chocolate mint), an increase from 46.2% in 2020. Tobacco flavor accounted for 10%, an increase from 8.79% in 2020.

- Nicotine concentrations

- The average nicotine concentration of e-cigarette cartridges in 2021 was 51.22 mg/ml, the same as in 2020.

- The average nicotine concentration of disposable e-cigarettes in 2021 was 48.53 mg/ml, a decrease from 50.48 in 2020.

- Bundling

- The proportion of cartridge system devices sold or given away bundled with cartridges increased from 2.5% in 2020 to 7.1% in 2021, but this follows a steep decline from a high of 97.1% in 2015.

- In 2020 and 2021, nearly all (99.8%) cartridges were distributed separately from a cartridge system device.

- In 2021, nearly all cartridges were sold in packs of 4 (78.5%) or 2 most (20.4%). Less than 1% were sold in packs of three or as single cartridges, and none were sold in packs greater than 4.

- Nearly all disposable e-cigarettes were sold as singles.

Advertising and Promotions

E-cigarette companies spent $859.4 million on advertising and promotion in 2021, an increase of $90.6 million from 2020. Most of this spending came from the five leading cartridge-based e-cigarette manufacturers, while less than $500,000 of these expenditures were on disposable e-cigarettes.

E-cigarette companies spent $859.4 million on advertising and promotion in 2021, an increase of $90.6 million from 2020. Most of this spending came from the five leading cartridge-based e-cigarette manufacturers, while less than $500,000 of these expenditures were on disposable e-cigarettes.- Over 84% of all e-cigarette advertising expenditures were focused on the retail environment, with the largest categories for expenditure being price discounts, promotional allowances, and point-of-sale advertising. This spending mirrors the pattern we see with marketing expenditures for cigarettes and smokeless tobacco, for which the vast majority is also spent in the retail environment. Here’s what e-cigarette companies are they’re spending their marketing dollars on:

- Price discounts: This is the single largest category of spending, totaling $261.6 million in 2021. It includes payments to retailers and wholesalers to reduce the price of e-cigarettes to consumers. Price discounts also lead to higher rates of tobacco use among youth.

- Promotional allowances paid to retailers totaled $76.6 million in 2021. This can include payments for stocking, shelving, displaying, and merchandising brands, slotting fees, volume rebates, incentive payments, and the cost of e-cigarette products given to retailers for free for subsequent, resale to consumers.

- Promotional allowances paid to wholesalers totaled $194.8 million in 2021. This can include payments for volume rebates, incentive payments, value-added services, promotional execution, and satisfaction of reporting requirements.

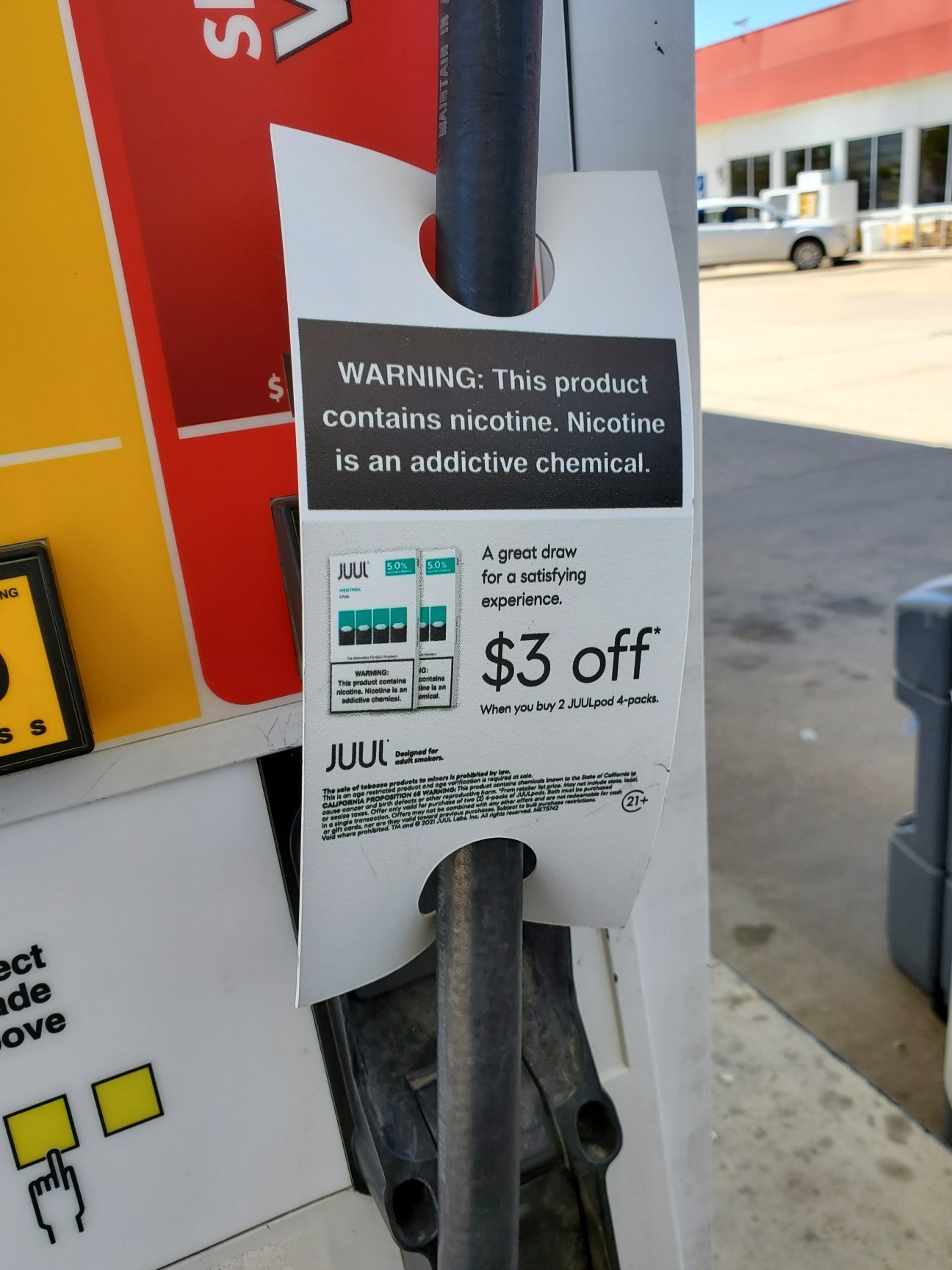

- Point of Sale Advertising expenditures totaled $96.5 million in 2021. This includes any advertising displayed or distributed at a physical retail location.

- Coupons are another way e-cigarette companies reduce the price of their products to consumers, and they spent $27.4 million on coupons in 2021.

- Sampling expenditures totaled $59.5 million in 2021. This includes the distribution of free e-cigarette products and the distribution of e-cigarette products sold at a price of $1 or less. Note that many companies offer products at $1 or less to get around the FDA’s 2016 ban on free samples.

E-cigarette companies are spending their money where they know it matters. They’re aiming to keep their products cheap and visible in the retail environment. Research shows that exposure to tobacco marketing can cause youth to start smoking, keep people who currently smoke hooked, and make it harder for people to quit and stay quit. E-cigarette companies know that keeping prices low drives use. While research on the impacts of e-cigarette pricing is less extensive than on the impacts of cigarette pricing, the existing data show that both disposable and reusable e-cigarette sales are also responsive to price.[1] When e-cigarette prices increase, sales decrease, particularly among price-sensitive groups like youth. We know that lower prices, along with coupons and price discounts, encourage youth to start smoking and move them along from experimentation to regular cigarette use.[2] E-cigarette companies engage in these practices because the same thing is likely to happen with e-cigarettes.

E-cigarette companies are spending their money where they know it matters. They’re aiming to keep their products cheap and visible in the retail environment. Research shows that exposure to tobacco marketing can cause youth to start smoking, keep people who currently smoke hooked, and make it harder for people to quit and stay quit. E-cigarette companies know that keeping prices low drives use. While research on the impacts of e-cigarette pricing is less extensive than on the impacts of cigarette pricing, the existing data show that both disposable and reusable e-cigarette sales are also responsive to price.[1] When e-cigarette prices increase, sales decrease, particularly among price-sensitive groups like youth. We know that lower prices, along with coupons and price discounts, encourage youth to start smoking and move them along from experimentation to regular cigarette use.[2] E-cigarette companies engage in these practices because the same thing is likely to happen with e-cigarettes.

To learn more about e-cigarette sales and marketing expenditures, read the press release from the FTC or download the full report. To learn more about how tobacco companies spend their marketing dollars on cigarettes and smokeless tobacco, read our summary on the War in the Store. Learn more about e-cigarettes at the point of sale in our evidence summary.