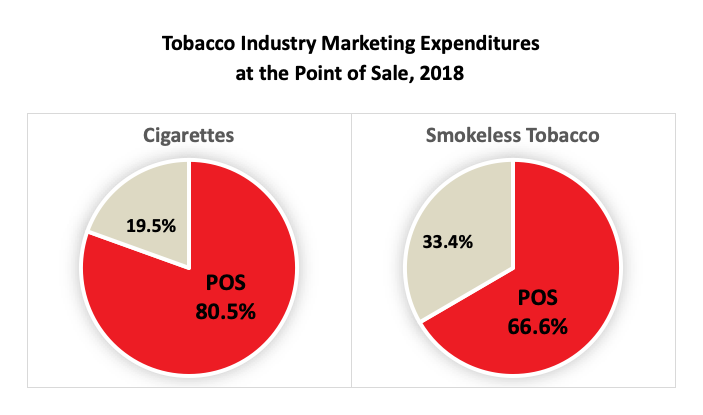

In 2018, the tobacco industry spent over $7.2 billion marketing and promoting cigarettes and smokeless tobacco directly at the point of sale (POS).

These POS expenditures account for nearly 80% of the tobacco companies’ total marketing dollars spent on cigarettes and smokeless tobacco combined. These figures from the Federal Trade Commission (FTC) Reports on Cigarettes and Smokeless Tobacco Sales and Marketing Expenditures in 2018, released in December 2019, document a continued concentration of tobacco industry expenditures at the POS. The FTC has been preparing reports on sales, advertising, and promotions of cigarettes since 1967 and smokeless tobacco since 1987. Reports are issued periodically and give tobacco control advocates detailed advertising and promotion spending reports in more than two dozen categories. The spending reports show that tobacco companies spend the majority of their marketing dollars on two categories: price discounts and promotional allowances to keep products cheap and visible at the point of sale. See more details here.

When factoring in price discounts and promotional allowances paid to wholesalers, which also ultimately reduce the price of products to consumers, the amount spent rises over 96% of the tobacco industry’s total marketing budget. These price discounts counteract the impact of tobacco control policies like excise taxes and target price sensitive smokers.

- What are Price Discounts? Price discounts are what tobacco companies pay to cigarette retailers or wholesalers in order to reduce the price of cigarettes to consumers, including off-invoice discounts, buy-downs, voluntary price reductions, and trade programs.

- What are Promotional Allowances? Promotional allowances are what tobacco companies pay to either cigarettes retailers or wholesalers in order to facilitate the sale or placement of tobacco products. For retailers, this can include payments for stocking, shelving, displaying and merchandising brands, volume rebates, incentive payments, and the cost of tobacco products given to retailers for free for subsequent sale to consumers. For wholesalers, this can include payments for volume rebates, incentive payments, value added services, promotional execution and satisfaction of reporting requirements.

While the total amount tobacco companies spent on marketing for cigarettes and smokeless tobacco decreased by 3% in 2018, the proportion that they spend directly in the retail environment rose by 2%. Price discounts remain one of the largest categories for both cigarettes and smokeless tobacco, totaling 85.8% of total industry spending on these products. From 2017 to 2018, price discounts for wholesalers increased by 11%, and price discounts for retailers increased by 6% for smokeless tobacco. While expenditures on coupons for smokeless tobacco dropped, expenditures on coupons for cigarettes increased by 5% from 2017-2018.

Remember that these numbers are for cigarettes and smokeless tobacco alone – they do not include any marketing expenditures for cigarillos, little cigars, e-cigarettes, or any other tobacco products. However, the FTC may issue future reports on e-cigarette marketing expenditures – in October 2019, the FTC announced that they had issued orders to six e-cigarette manufacturers requesting information on their sales, advertising, and promotional methods from 2015-2018.

Tobacco marketing at the point of sale matters. Research shows that tobacco marketing can cause youth to start smoking, keep current smokers hooked, and make it harder for current and former users to quit and stay quit. These FTC reports emphasize the critical need to monitor and address tobacco industry activity in the retail environment. Learn more about the FTC reports, The War in the Store, and strategies to limit price discounts, promotions, and POS advertising in your community.

Note: In 2016, the FTC Cigarette and Smokeless Tobacco Reports began separating price discounts into amounts paid to retailers and amounts paid to wholesalers. In previous calculations, we had included this category as a whole. In an effort to keep track of what is directly spent at tobacco retail locations like convenience stores that any person can access, we calculate the amount spent at the POS uses the following categories: (a) point-of-sale advertisements, (b) price discounts to retailers, (c) promotional allowances to retailers, (d) retail-value added bonus tobacco products and bonus non-tobacco products, (e) coupons, and (f) consumer engagement. Other marketing dollars not considered to be aimed at POS include, for example, dollars spent on direct mail, magazines, internet, or sponsorships. However, we also are reporting totals including price discounts and promotional allowances paid to wholesalers for their role in reducing the price of tobacco products for consumers.