Flavored Tobacco Products

The 2009 Family Smoking and Tobacco Prevention Act banned the sale of cigarettes with “characterizing” flavors other than menthol or tobacco.

However, other flavored tobacco products have remained on the market and become much more prevalent in the years since. These products include flavored smokeless tobacco, little cigars and cigarillos, large cigars, e-cigarettes, hookah, and oral nicotine products (e.g. pouches), in addition to menthol cigarettes, and are sold in an array of flavors that range from fruit flavors to candy or confectionery flavors, to alcoholic beverage to herbs and spices.

The ban on flavored cigarettes was associated with a 17% reduction in the probability of middle and high school youth becoming smokers and a 58% reduction in cigarettes smoked by youth who smoke. However, the ban was also associated with an increase 45% increase in use of menthol cigarettes, a 34% increase in use of cigars, and a 55% increase in use of pipes, indicating that youth may be substituting menthol cigarettes and other flavored tobacco products in place of flavored cigarettes. Overall, the probability of youth using any form of tobacco dropped by 6% following the ban on flavored cigarettes, showing the impact that restrictions on flavored tobacco products can have. However, the increases in use of other products that are commonly flavored is concerning and points towards the potential impact that more comprehensive restrictions on menthol cigarettes and all flavored other tobacco product could have on youth tobacco use.[1]

On November 15, 2018 the FDA announced that they intend to issue a product standard that would ban all flavored cigars and that they intend to issue a Notice of Proposed Rulemaking to ban menthol in cigarettes, cigars, and any other combustible tobacco product. On March 13, 2019, the FDA issued a draft compliance policy for flavored e-cigarettes and flavored cigars. However, then FDA Commissioner Scott Gottlieb left his post the following month. In response to youth e-cigarette epidemic, on September 11, 2019, the Trump administration announced a future ban on the sale of flavored e-cigarettes, but final guidance from the FDA, issued January 2, 2020, only prohibits the sale of flavored cartridge-based (closed system) e-cigarette products other than menthol or tobacco flavor.

On April 28, 2022, the FDA announced a proposed rule to prohibit menthol as a characterizing flavor in cigarettes, as well as prohibit menthol and all other characterizing flavors in cigars. The docket for public comment on these two rules received nearly 250,000 comments altogether (You can search and view all submitted comments here for rule on menthol cigarettes and here for the flavored cigars rule). The rule was submitted to the White House for final review in October 2023, but the Biden administration announced the final review will not be approved until at least March 2024.

- Read the FDA’s full press release here.

- Read the proposed tobacco product standard for menthol in cigarettes.

- Read the proposed tobacco product standard for characterizing flavors in cigars.

- FDA Fact Sheet: Proposed product standards to prohibit menthol as a characterizing flavor in cigarettes and all characterizing flavors (other than tobacco) in cigars

While this is a major step forward for public health, health equity, and the commercial tobacco endgame, the processes for finalizing and implementing these rules could take years, especially with delays from likely tobacco industry litigation. State and local action to prohibit the sale of menthol cigarettes and all other tobacco products remains critical and can save lives and prevent addiction now.

Click on the following topics below to learn why these steps are important, why further action is needed for both broad public health benefit and health equity, and what steps local and state governments have taken to implement similar and/or broader changes in their communities:

- The Data: What are Flavors & How Common are They?

- Prevalence of Use

- Initiation

- Point of Sale Marketing

- Federal, State, and Local Policy

- Resources

The Data: What are Flavors & How Common are They?

The 2009 Family Smoking and Tobacco Prevention Act describes flavors as: “an artificial or natural flavor (other than tobacco or menthol) or an herb or spice, including strawberry, grape, orange, clove, cinnamon, pineapple, vanilla, coconut, licorice, cocoa, chocolate, cherry, or coffee, that is a characterizing flavor of the tobacco product or tobacco smoke.”

They are widely sold in stores across the country. According to national store observation data collected in 2014,

- 84.6% of stores sell flavored little cigars and cigarillos

- 67.3% of stores sell flavored smokeless products

- Almost half of stores sell flavored e-cigarettes or large cigars [2]

However, flavored tobacco products are not marketed and sold uniformly across the United States. A 2015 systematic review found that marketing for menthol products was more prevalent in low-income and African American neighborhoods, and marketing for little cigar/cigarillos (which are often flavored) is more prevalent in neighborhoods with more African-American residents.[3] Stores in neighborhoods with the highest concentration of African-American residents had more than two times greater odds of selling flavored cigars.[4]

Sales of flavored cigars increased by nearly 50% between 2008 and 2015, growing to comprise over half of the cigar market. Low cost 2 or 3-packs increased from less than 1% of cigar sales in 2008 to 40% in 2015, and are available in at least 250 different flavors.[5]

Menthol flavored cigarettes were excluded from the 2009 Family Smoking and Tobacco Prevention Act after the tobacco industry fought to keep them on the market.[6] While many local-level policies restricting the sale of flavored tobacco products have similarly made exceptions for menthol, that trend is beginning to change. Learn more about menthol in particular here. Learn more about local-level polices below.

E-cigarette Flavors

E-cigarettes entered the US market in 2007 and had been largely unregulated until May 2016, when the FDA issued their final deeming rules, which brought regulation of e-cigarettes under FDA authority. Currently, there are an enormous amount of flavors and a wide variety of e-cigarette products and brands on the market. In 2014 there were a total of 7,765 flavors and 466 brands, and the market has only grown since then.[7]

While the research base on e-cigarettes is still emerging, a number of studies have found that the flavoring used in e-cigarettes and e-liquids have been linked to serious health issues, including toxic effects on lung cells, including “popcorn lung,” as well as inflammation effects and negative effects on the immune system. While the the flavorings used often have been deemed “generally recognized as safe” by the FDA, this status refers to safe for consumption, rather than for inhalation, which can have different effects on the body.

In response to what FDA Commissioner Gottlieb termed an e-cigarette use “epidemic” among youth, driven in part by the youth-appealing flavors of e-cigarettes, in November 2018, the FDA announced restrictions on the sale of flavored e-cigarettes. The new policy framework would restrict all electronic nicotine delivery system products, including e-liquids, cartridge-based systems and cigalikes, sold in flavors except tobacco, mint and menthol, to age-restricted (18+) locations only. The restriction does not apply to most vape shops or other adult-only retail stores. On March 13, 2019, the FDA issued a draft compliance policy for flavored e-cigarettes and flavored cigars. However, FDA Commissioner Scott Gottlieb left his post the following month. In response to youth e-cigarette epidemic, on September 11, 2019, the Trump administration announced a future ban on the sale of flavored e-cigarettes, but final guidance from the FDA, issued January 2, 2020, only prohibits the sale of flavored cartridge-based (closed system) e-cigarette products other than menthol or tobacco flavor.

For more information, review our evidence summary on E-Cigarettes at the Point of Sale.

Prevalence of use

Youth and Young Adults

According to the 2021 National Youth Tobacco Survey, 80% of middle or high school students who currently use any tobacco product reported using a flavored product. Use of flavor was common across products, with the proportion of youth who use a given product reporting use of flavors being:

- 84.7% of e-cigarettes

- 70.1% for smokeless tobacco

- 61.6% for oral nicotine pouches

- 46.6% for hookah

- 44.4% for cigars

- 38.8% for cigarettes (menthol)

- 34.4% for pipe tobacco.

The appeal of flavored products continues into young adulthood. A survey of young adults ages 18-34 showed that younger adults ages 18-24 are also more likely to use flavored products than older adults.[9]

However, prohibiting the sale of flavored tobacco products can help reduce youth tobacco use. Following New York City’s 2009 ban on the sale of flavored non-cigarette tobacco products, teens had a 37% lower odds of every trying a flavored tobacco product and 28% lower odds of using any tobacco product.[35] An evaluation of Providence, Rhode Island’s 2012 tobacco policies that restricted the sale of flavored tobacco products (except menthol) to tobacco bars and restricted price discounting and multi-pack offers for tobacco products found them to be effective, with a reduction in high school students’ use of any tobacco products from 22.2% to 12.1% and current use of e-cigarettes from 13.3% to 6.6% following two years of rigorous enforcement of the policy. [34]

Youth e-cigarette product use has also responsive to regulation of flavors. Many youth have pivoted from using pre-filled pods and cartridges like Juul, which were banned in flavors other than menthol and tobacco at the beginning of 2020, to using disposable e-cigarettes, which are still available in a variety of flavors. In fact, rates of disposable e-cigarette use among high school students skyrocketed from 2.4% in 2019 to 26.5% in 2020. By 2021, disposables were the most popular type of e-cigarettes. Learn more about policy options for restricting the sale of flavored e-cigarettes.

Menthol Use

The tobacco industry has targeted low-income African American communities with marketing for menthol cigarettes for decades. Higher amounts of POS marketing and lower prices for menthol products can be found in predominantly African American and low-income neighborhoods.[15]

As a result, menthol cigarettes are disproportionately smoked by Black people. In fact, after controlling for other demographic factors and smoking behaviors, one study found that black people who smoke were more than 10 times more likely to smoke menthol than white people who smoke. That same study found that individuals with lower levels of education, individuals with lower levels of income (<$10,000), and women were also more likely to smoke menthol cigarettes. [14]

Menthol is also preferred by young people, as it helps mask the harshness and taste of tobacco smoke. Of youth and young adults who smoke, over half smoke menthol.[13]

Menthol use has also increased among white, Asian, and Hispanic people who smoke since 2010.[16]

Learn more about menthol tobacco products here. Read more about disparities in point of sale marketing here.

Initiation

Evidence suggests that flavors play a key role in youth initiation of tobacco use.

A national survey found that the majority of youth ages 12-17 reported that the first tobacco product they tried was flavored (88.7% of youth who ever smoked hookah, 81% of youth who ever used an e-cigarette, 65.4% of youth who ever smoked a cigar, and 50.1% of youth who ever smoked a cigarette).[17] Youth also reported product flavoring as a top reason for using tobacco within the past 30 days (81.5% of youth who use e-cigarettes, 78.9% of youth who use hookah, 73.8% of youth who smoke cigars, 69.3% of youth who use smokeless tobacco, and 67.2% of youth who use snus).[17]

In addition, longitudinal data has shown that youth and young adults whose first use of tobacco was with a flavored product were more likely to subsequently use tobacco products.[36]

Studies have also shown that flavoring impacts peoples’ perceptions of the level of harm. Harmful flavored tobacco products like cigars, smokeless tobacco, and e-cigarettes attract both people who have never smoked as well as those that currently do with their colorful packaging, taste less harsh, and are perceived as less harmful to health than unflavored products.[19] One study showed that children and adolescents have a more of a preference towards sweet flavors than adults, making sweet flavored products a key tool in smoking initiation for youth.[20] Sweet and menthol flavors also increase the appeal of e-cigarette use for youth. The perception of harm reduction can make youth more likely to try e-cigarettes over combustible tobacco products and alcohol in general, but youth also perceive sweet, fruit, or candy flavors as less harmful than tobacco flavored e-cigarettes.[21, 33]

Focus groups of young adults who smoke have revealed that the visual, smell, and taste cues from the packaging of little cigars and cigarillos (LCCs) influence their decision to start smoking them or to switch from cigarettes to flavored LCCs.[18]

Point of Sale Marketing

Tobacco Industry History of Marketing to Youth

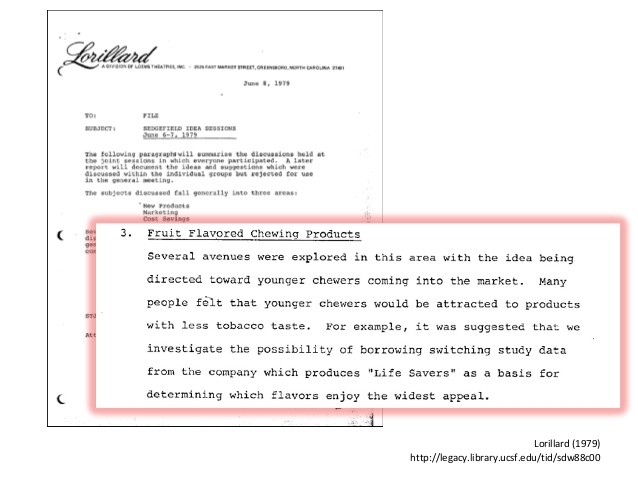

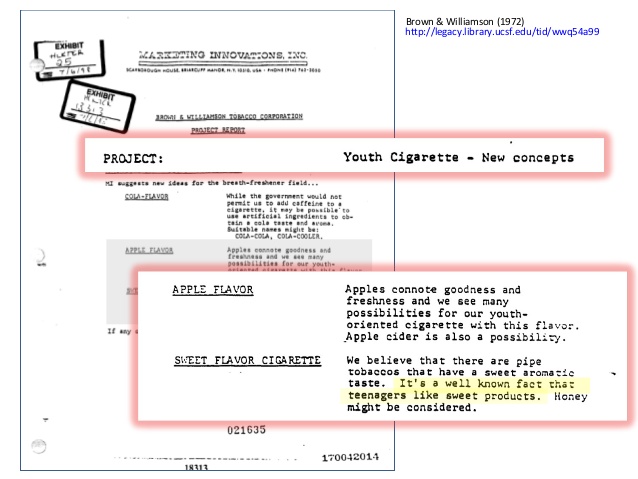

The tobacco industry has a long history of marketing their products to youth. Tobacco industry documents archived through the UCSF Industry Documents Digital Library show that tobacco companies strategically used sweet, fruity, candy-like flavors to market their products to youth:

Both direct and indirect marketing to youth were prohibited under the 1998 Master Settlement Agreement. However, it’s clear that this type of targeted marketing still occurs. For more recent quotes from the industry, evidence, and consequences of tobacco companies using flavors to target youth, review the following:

Both direct and indirect marketing to youth were prohibited under the 1998 Master Settlement Agreement. However, it’s clear that this type of targeted marketing still occurs. For more recent quotes from the industry, evidence, and consequences of tobacco companies using flavors to target youth, review the following:

- Campaign for Tobacco Free Kids’ In Their Own Words: What Cigar Companies, Retailers, And Analysts Say About Cheap And Kid-Friendly Products and Smokeless Tobacco and Kids

Not only are tobacco products sold in candy flavors, many are also packaged similarly to popular candies.

- For a fun and awareness-raising activity, match the tobacco product to it’s candy twin in our Advocate Against Youth Targeting activity guide.

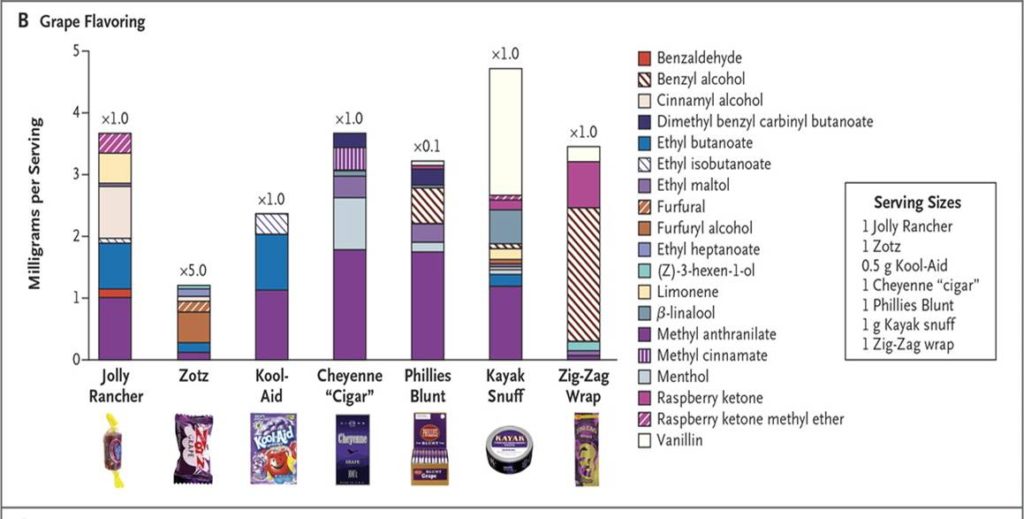

Some tobacco products even contain the same chemical ingredients as candy. A study published in the New England Journal of Medicine showed that the same chemicals used in “cherry,” “grape,” “apple,” “peach,” and “berry” Jolly Rancher candies, Life Savers, Zotz candy, and Kool-Aid drink mix were also used in similarly flavored tobacco products. It’s literally candy-flavored tobacco![22]

Menthol Marketing to African Americans

The tobacco industry also been marketing their menthol products to African Americans through targeted campaigns since the 1970s, concentrating advertising and promotions in predominately African American neighborhoods and with campaigns that exploit cultural hallmarks and stereotypes. Read more about the “Menthol Wars” and urban African American neighborhoods as “focus communities.”

Still today, studies show that more point of sale menthol marketing is found in areas with higher numbers of African-American residents.[23] For more information, review the following:

- CDC OSH Webinar: POS Strategies Guide and Tobacco Control and Social Justice: What’s Menthol Got To Do With It?

- ClearWay MN’s Video: Menthol Cigarettes 101

This marketing works. CDC MMWR data shows that 60% of African American youth prefer Newport, a brand of menthol cigarettes, compared to 22% of white youth.[24]

However, according to a 2011 report by the FDA’s Tobacco Products Scientific Advisory Committee (TPSAC), removing menthol cigarettes from the marketplace would benefit public health. They estimated that the effects of such a ban would have included:

-

- 39% of people who smoke menthol would quit

- 47% of African Americans who smoke menthol would quit

- preventing over 17,000 fewer premature deaths by 2020

- preventing nearly 2.3 million people from initiating smoking by 2020 [21]

Federal, State, and Local Policies

Federal

The FDA’s 2016 “Deeming” regulations brought all tobacco products under FDA regulatory authority – including e-cigarettes, all cigars, hookah, and any novel or future tobacco products. In August 2017, the FDA announced their intention to issue another advance notice of proposed rule-making (ANPRM) to seek public comment on the role that flavors in tobacco products—including menthol—play in attracting youth, as well as the role they may play in helping some people who smoke switch to potentially less harmful forms of nicotine delivery. The agency officially issued the ANPRM on the regulation of flavored tobacco products on March 20th, 2018, and in November 2018, announced their next steps on flavored tobacco products, including their intention to: issue a product standard that would ban flavors in all cigars; issue a notice of proposed rulemaking that would ban menthol cigarettes, cigars, and any other combustible products; and restrict the sale of flavored e-cigarettes (other than tobacco, mint, or menthol flavor) to age-restricted retail locations. On March 13, 2019, the FDA issued a draft compliance policy for flavored e-cigarettes and flavored cigars. However, then FDA Commissioner Scott Gottlieb left his post the following month. In response to youth e-cigarette epidemic, on September 11, 2019, the Trump administration announced a future ban on the sale of flavored e-cigarettes, but final guidance from the FDA, issued January 2, 2020, only prohibits the sale of flavored cartridge-based (closed system) e-cigarette products other than menthol or tobacco flavor. No further federal action has been taken on flavored cigars or menthol cigarettes. However, states and localities aren’t waiting for federal action. As of December 31, 2021, 393 local jurisdictions and 3 Tribes had some type of restriction on the sale of flavored tobacco products in place – see the full list from in this report from the Truth Initiative.

On April 28, 2022, the FDA announced a proposed rule to prohibit menthol as a characterizing flavor in cigarettes, as well as prohibit menthol and all other characterizing flavors in cigars. public comment on the proposed rules will be open through July 7th. The FDA will also hold two public listening sessions on the proposed rules in June 2022.

- Read the FDA’s full press release here.

- Read the proposed tobacco product standard for menthol in cigarettes and submit comments here.

- Read the proposed tobacco product standard for characterizing flavors in cigars and submit comments here.

- FDA Fact Sheet: Proposed product standards to prohibit menthol as a characterizing flavor in cigarettes and all characterizing flavors (other than tobacco) in cigars

While this is a major step forward for public health, health equity, and the commercial tobacco endgame, the processes for finalizing and implementing these rules could take years, especially with delays from likely tobacco industry litigation. State and local action to prohibit the sale of menthol cigarettes and all other tobacco products remains critical and can save lives and prevent addiction now.

When the 2009 Family Smoking Prevention and Tobacco Control Act banned flavored cigarettes, it also instituted a tax on small cigars. To circumvent this tax, the tobacco industry subsequently slightly increased the weight of their cigars to be able to classify them as “large cigars” under Tobacco Control Act. However, these cigars are nearly identical to cigarettes, yet still allowed to be flavored. While cigarette sales have been declining, cigars have been on the rise in the US since 2000, driven in part by the proliferation of flavored LCCs. [25]

- Learn more about this trend in Campaign for Tobacco Free Kids’ 2023 updated report “Not Your Grandfather’s Cigar

- Learn more about types of cigars in this Little Cigars, Cigarillos & Cigars fact sheet from Truth Initiative

The tobacco industry also has a history of using colors on packaging to signify differences between products. When the 2009 Tobacco Control Act prohibited the use of modified risk health descriptors such as “light,” “mild,’ or low tar in cigarettes, Marlboro circumvented the rule by changing the names of their “Marlboro Light” cigarettes to “Marlboro Gold,” while “Marlboro Ultra Lights” became “Marlboro Silver” and “Marlboro Mild” was renamed “Marlboro Blue”. [26] Many LCCs on the market sold alongside other flavors are labeled simple with a color (i.e. ‘Green” “Blue” “Black” “Silver” as seen in the photo at right). Researchers tracked cigar sales between 2008 and 2014 by flavor categories and found that flavored cigars accounted for over half of cigar sales. [27] However, the number of fruit flavors is declining, while “other” flavors sometimes called “concept” or “ambiguous” flavors (e.g. “Jazz,” “Golden,” and “Royale”) are on the rise, which the authors suggest may be part of a tobacco industry attempt to avoid characterizing flavor descriptors in the case of a ban on flavored cigars.[28] These products have been described by people who use them as flavored. [29] In addition, an analysis of 16 tobacco products purchased in NYC in 2015 that did not have explicit flavor names (but were labeled with descriptors such as “blue” or “royale”) found that 14 out of the 16 had flavor chemical levels higher than products labeled with a flavor (such as “peach” or “grape”).[29]The researchers concluded that the tobacco industry has renamed flavored products to avoid identifying them as such. They also suggest that the FDA could require that all tobacco products indicate when flavorings are present above a set level, which local jurisdictions could then use to enforce sales restrictions on flavored tobacco products. This may be an important step to take, as an evaluation of Providence, RI’s restriction on the sale of flavored non-cigarette tobacco products showed that while sales of cigars with explicit flavor names decreased by 93% between 2012 and 2016 within the city, sales of cigars labeled with concept flavors rose by 74%.[30]

State

In November 2019, Massachusetts became the first state to prohibit the sale of all flavored tobacco products, including menthol cigarettes and flavored e-cigarettes. The only exception to the law is that flavored tobacco products can still be sold at licensed smoking bars such as cigar bars and hookah lounges, though consumption must occur on-site. Extending the ban to menthol cigarettes is particularly monumental as these products have generally been exempt from past restrictions and are disproportionately smoked by youth and minority populations, in part due to targeted industry marketing of menthol to these specific populations. The law went into effect in June 2020.

In August 2020, California passed a law prohibiting the sale of most flavored tobacco products, making it the second state to prohibit the sale of menthol cigarettes and the fourth to prohibit the sale of flavored e-cigarettes. The only products exempt from the policy are loose leaf tobacco, “premium” cigars, and hookah tobacco. After the tobacco industry forced the policy to a referendum vote, in November 2022, California voters upheld ban over 63% of the vote, and the policy has since withstood all other industry challenges and was implemented in December 2022.

Other state policies have been limited to specific products. Maine banned flavored cigars in 2009, and more recently, a number of states have banned or restricted the sale of flavored e-cigarettes:

- New Jersey, and Rhode Island have both banned the sale of all flavored e-cigarettes.

- New York has banned the sale of all flavored e-cigarettes except those that are approved through the FDA’s premarket review process.

- Maryland has banned the sale of all flavored cartridge-based and disposable e-cigarettes (except menthol flavor)

- Utah has restricted the sale of flavored e-cigarettes, other than mint and menthol, to tobacco specialty businesses.

Some states have run media campaigns raising awareness about the dangers of flavored tobacco products, particularly for youth. For example:

-

- Campaign in Maryland – The Cigar Trap – an education and awareness campaign around the issues associated with the merchandising and promotion of cigars. In 2010, 14.1% of Maryland high school students under 18 reported smoking cigarettes in the last 30 days, and 13.9% reported smoking cigars. This represented more than an 11% increase in cigar use since 2000. The Cigar Trap highlights this shift in usage and the associated dangers. The campaign includes facts sheets to define the issue, solutions that can be pursued, and media resources associated with the campaign. Media resources can also be accessed through the CDC’s Media Campaign Resource Center.

- Tobacco Free CA’s “Kids and the Tobacco Predator”

Local

As of December 2023, at least 375 local jurisdictions across the country have implemented regulations that restrict the sale of flavored tobacco products, of which at least 190 include a ban on the sale of menthol cigarettes. While the movement to ban the sale of flavored tobacco products started with incremental change, as jurisdictions prohibited where flavored products could be sold by store type (e.g. only in age-restricted stores), store location (e.g. not at stores near schools), or prohibited only certain flavored tobacco products (e.g. only flavored cigars, only flavored e-cigarettes, and often exempting menthol cigarettes), comprehensive restrictions that prohibit the sale of all flavored tobacco products without exemption is the gold standard.

For examples and a current list of jurisdictions with flavored tobacco sales restrictions or ban in place see:

- States & Localities That Have Restricted the Sale of Flavored Tobacco Products, Campaign for Tobacco Free Kids

- Local restrictions on flavored tobacco and e-cigarette products, Truth Initiative

- US Sales Restrictions on Flavored Tobacco Products, Public Health Law Center

Some jurisdictions have also passed policies that indirectly reduce the availability of flavored tobacco products. For example, minimum price laws or minimum pack size requirements for little cigars and cigarillos (LCCs) can also limit access to flavored tobacco products. While these laws do not specifically pertain to flavored products, they disproportionately affect flavored products like LCCs.In 2011, Boston implemented a cigar packaging and pricing regulation that required single cigars to cost more than $2.50, a package of two cigars to cost more than $5.00, and a package of three cigars to cost more than $7.50. Otherwise, the regulation stipulated that cigars must be sold in packages of at least four. As a result, research showed that both sales and retail availability of single grape-flavored Dutch Masters cigars (which are popular with youth) decreased. Between 2011 and 2014, the percentage of Boston retailers selling grape Dutch Masters single cigars decreased by 34.5%. Additionally, the number of neighborhoods with 3 or more retailers selling these cigars per 100 youth residents decreased from 12 stores to 3, reducing neighborhood-level disparities in retail availability. [31]

Implementation and Enforcement

Interviews with health department staff, researchers, legal professionals, and local government officials point towards some key best practices for adopting, implementing, and enforcing bans or restrictions on the sale of flavored tobacco products, including:

- using comprehensive policy language, including menthol

- identifying enforcement agents with sufficient capacity

- setting clear enforcement procedures, including for concept flavors

- implementing the policy through licensing with the potential for fines as well as license suspensions and revocations for violations

- examining potential economic and financial considerations

- deploying media campaigns to raise community awareness

- engaging community partners, including community members, priority populations, and youth

- engaging retailers as partners

- provide retailers with effective education, ideally through one-on-one outreach

- collecting baseline data to be able to demonstrate the impact of the policy, including disaggregated demographic data and data examining menthol separately from other flavors

See more in Public Health Law Center’s Flavored Tobacco Toolkit: Lessons Learned about Implementation of Flavored Policies, including:

- Flavored Tobacco Sales Prohibitions: Enforcement Options

- Evaluating Flavored Tobacco Sales Restrictions: A Literature Review

- Flavored Tobacco Sales Restrictions: An Interview with Cheryl Sbarra

- Case studies from San Francisco, CA; Massachusetts; Edina, MN; and Chicago, IL

Resources

- Model Ordinance: Restricting the Sale of Flavored Tobacco Products: Sample Language, Public Health Law Center

- Evaluation: Evaluating Flavored Tobacco Sales Restrictions: A Literature Review, Public. Health Law Center

Product Specific Resources:

- Keeping Hookah Tobacco in Flavor Restrictions: Why It’s Important for Health Equity, Public Health Law Center

- The Flavor Trap: How Tobacco Companies Are Luring Kids With Candy-Flavored E-Cigarettes and Cigars, Campaign for Tobacco Free Kids

Additional Policy Resources:

- Regulating Flavored Tobacco Products – Tips and Tools, Public Health Law Center

- The Tobacco Industry & The Black Community: The Targeting of African Americans, Public Health Law Center

- Truth Initiative’s Flavored Tobacco Resource Center, which includes their map of local flavor policies (updated quarterly) reports and publications, news updates, fact sheets, and case studies

- Summary of Scientific Evidence: Flavored Tobacco Products, Including Menthol, CDC Office on Smoking and Health

- Menthol and Cigarettes, CDC Office on Smoking and Health

Countering Opposing Arguments:

- Menthol Ban: Highlighting the Facts and Rebutting Tobacco Industry Misinformation, Public Health Law Center

- Flavored Tobacco Sales Restrictions Benefit Public Health: Responses to Misleading NATO/Swedish Match Arguments, Campaign for Tobacco Free Kids

- Potential Effects on Tobacco Tax Revenues of a Ban on the Sale of Flavored Tobacco Products, Tobacconomics

- Potential Effects of a Ban on the Sale of Flavored Tobacco Products in California, Tobacconomics

Media Campaigns:

- Minnesota’s Beautiful Lie, Ugly Truth

- Chicago’s Taste of Toxins Campaign

- Massachusetts’s Big Tobacco Is Sweet Talking Our Kids” Campaign

- Providence’s Sweet Deceit campaign

- YStreetVA’s The Problem with Flavored Tobacco: (dis)tasteful Campaign